In the world of Macro Markets, navigating through a plethora of noise is a daunting challenge. The key lies in effectively reducing this noise to uncover valuable signals. To address this fundamental issue, ingenious Macro Strategists have devised various filters to identify these signals amidst the overwhelming sea of information. Among these filters, the FX Filter stands out as a powerful tool that Portfolio Managers can rely on to make well-informed decisions on when to buy or sell. However, the human element of judgment introduces its own layer of noise, potentially hindering optimal outcomes.

To combat this, the process of judgment can be systematically structured, leading to a substantial reduction in noise and a remarkable improvement in decision quality.With the help of others, I have sought to transform this filter into a systematic trading algorithm with the ultimate goal of uncovering alpha in the market. By embracing a disciplined and data-driven approach, I aim to enhance the ability to discern valuable signals, and refine the trading strategy to achieve more consistent success in the ever-changing world of Global Macro

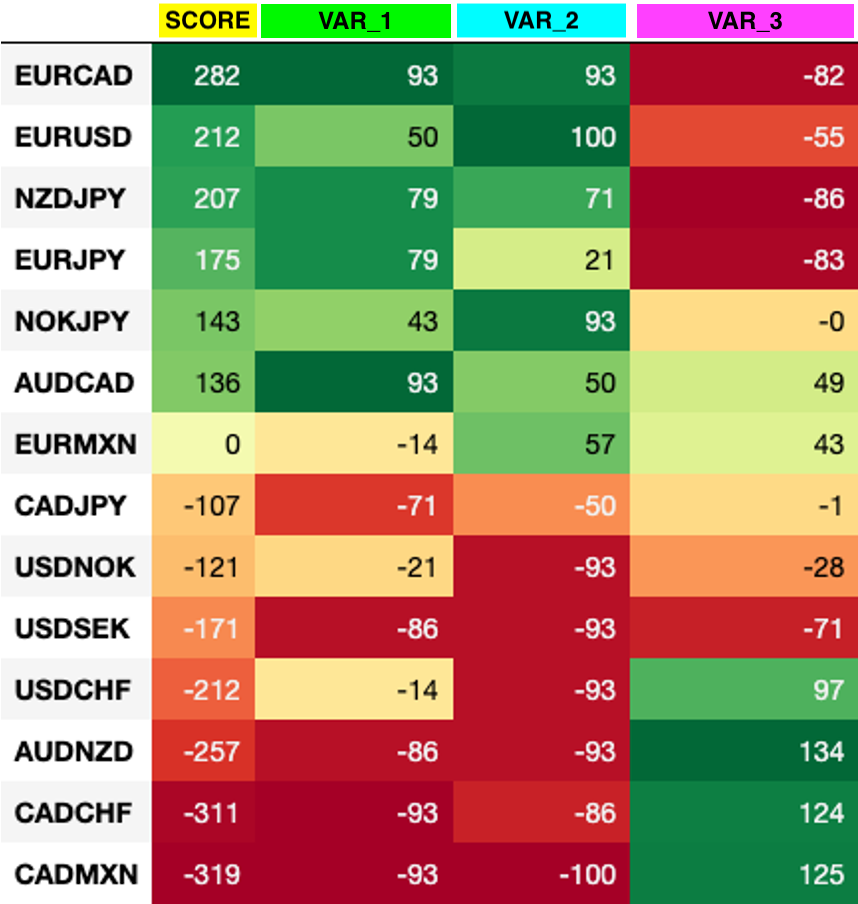

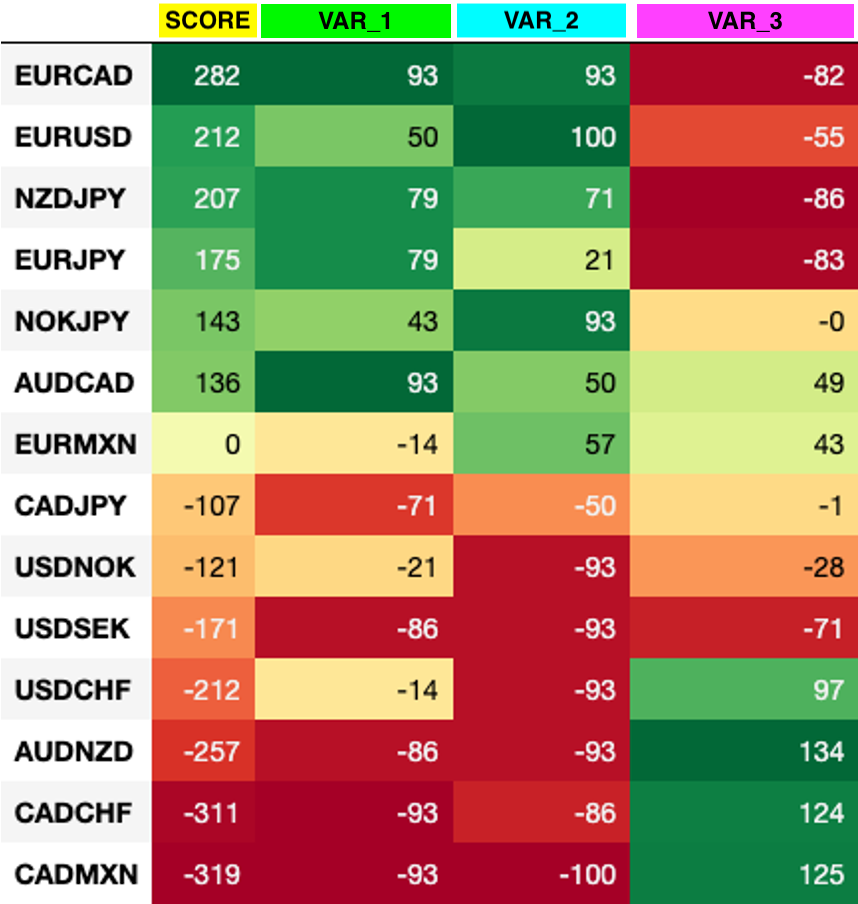

Currency pairs are evaluated based on three dynamic variables (var_1, var_2, var_3). Each of these variables - which can be considered as signals, indicators, or components - are assigned individual scores that change over time. The final score assigned to each currency pair is a composite of these three variables.

I form a cross-matrix for the third variable (var_3) between different currencies. To construct this matrix, I gather data for each currency, then create a cross-comparison between the pairs to derive a unique score. This process is repeated for each of the three variables.

The following animation illustrates how this cross-matrix evolves over a two-year period.

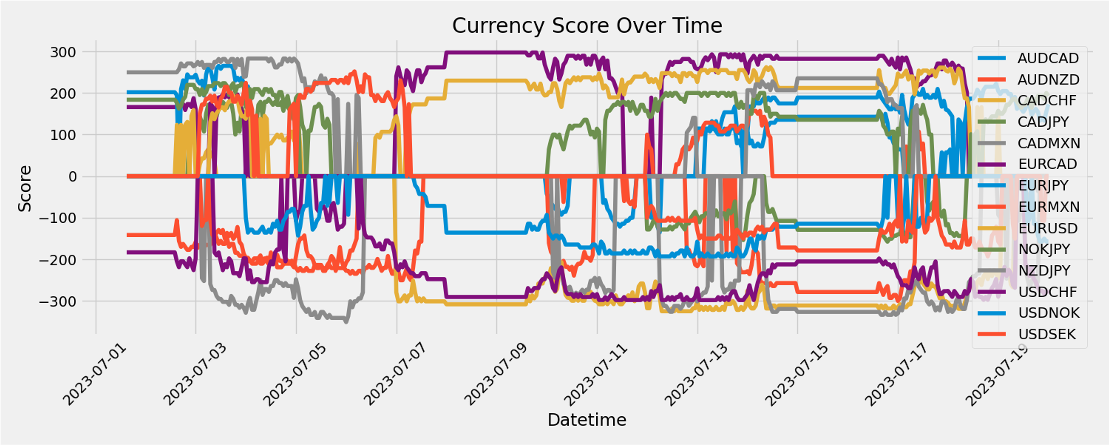

I plotted the scores for various currency pairs over time, allowing me to apply an arbitrary threshold. Using this threshold as a filter, I can start to devise trading strategies. For instance, if a currency pair's score exceeds 200, I adopt a long position on the pair and maintain it until the score falls below 200. Similarly, if the score drops below -200, I short the pair until the score rises above -200.

Click on the image to see the applied threshold

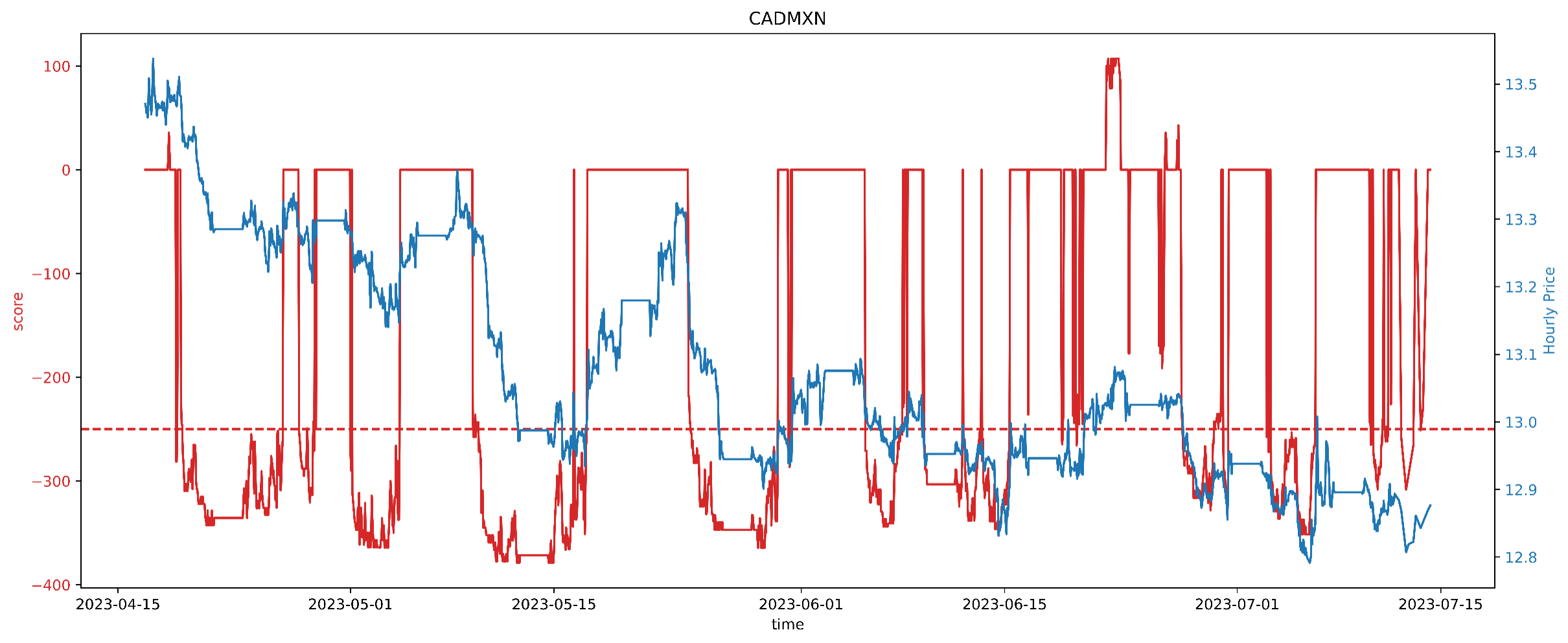

To provide a more detailed example, consider how well the score tracks the CADMXN currency pair's price. I can adopt a long position when the score exceeds the higher dotted red line and a short position when it drops below the lower dotted red line.

Long above the higher dotted red line. Short below the lower dotted red line

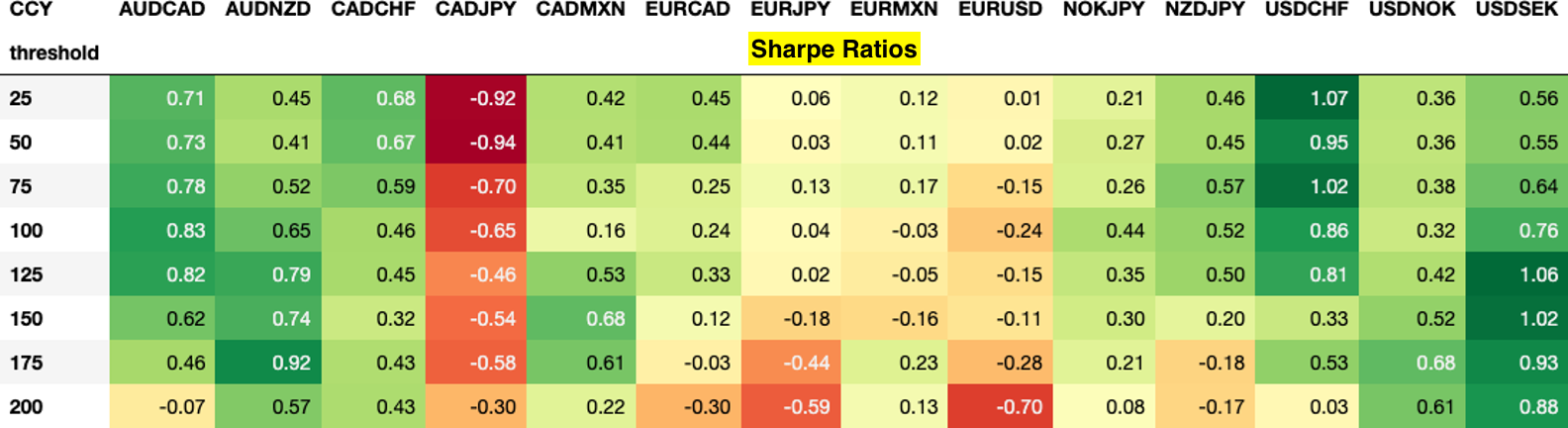

I conducted a backtesting exercise on two different trading strategies over a ten-year period, using various currency pairs. In this context, I used the Sharpe Ratio as my optimization variable.

1. Classic Strategy: I adopt a long position and maintain it when the score rises above a certain threshold. Conversely, I adopt a short position and hold it when the score falls below a certain threshold.

2. Mean Reversion Strategy: I adopt a short position and hold it when the score exceeds a threshold. Conversely, I adopt a long position and hold it when the score falls below a certain threshold.

The interplay between the Score Threshold and these Strategies was particularly illuminating. I didn't expect the mean reversion strategy to outperform the classic one.

Here's an overview of the Sharpe Ratios and Average Yearly Returns for the Mean Reversion Strategy. Interestingly, this strategy yields high alphas for specific currency pairs at certain score thresholds. Moreover, a Sharpe Ratio of 1 for those pairs is quite promising. However, whether this signal will remain robust in the future remains to be seen...

Click on the image to toggle between the Sharpe Ratio and the Average Yearly Returns.

The insights I gathered from the backtesting process were invaluable in evaluating the algorithm's effectiveness under different market conditions and across various currency pairs. This practical assessment allowed me to make informed decisions about the algorithm's performance and its potential for generating alpha in the market.